How do I do a BAS Statement

Unsure about when your tax lodgements are due? Stressing that your BAS statements haven’t been done and are now overdue? Are you a new small business and unsure of your GST obligations? Are you wondering, How do I do a BAS statement? Maybe you’ve been operating for a while and have been avoiding the whole tax conversation. Wherever you are along your business journey, this blog will quickly get you up to speed with Business Activity Statements and all things GST. Read on, because we explain things in simple English and use examples you can understand.

1. Understanding GST in Australia

In Australia, all of us pay Goods and Services Tax (GST) on the things we buy everyday. Foods, clothes, books, toys, drinks, furniture, professional services, hardware supplies — just about everything you can think of is taxed. Of course there are exceptions (basic foods like milk, bread and flour, essential services like water and sewerage, some medications, health and education services) but for the most part everything has a 10% tax added to the total.

The GST is charged at the cash register of your favourite coffee shop or supermarket, and if you look on the receipt, the amount of GST charged on your purchase will be highlighted. The coffee shop who sold you that latte and bagel must then send the GST you paid onto the Australian Taxation Office (ATO), along with a report known as a Business Activity Statement (BAS).

Your business has to do this too.

Registering for GST

Once your business reaches a certain threshold you must register your business for GST with the Australian Taxation Office. GST thresholds include:

- If you turnover more than $75,000 per year.

- If you’re a non-profit organisation and turnover more than $150,000.

- If you’re any type of taxi, limousine, or ride-share service (no matter how much money you make).

Once you’re over the 75k threshold you have 21 days to register for GST and start collecting Goods and Services Tax on everything you sell. Failing to register is just not an option — not only are there heavy fines and late fees, you will also have to backpay the GST from the date you should have been registered (out of your own pocket). How do I do a BAS statement?

You can register for GST online or by phoning the tax office — but if the whole thing sounds too complicated, one of our registered Tax Agents here at POP Business will be more than happy to do this for you. And remember, you’ll need an ABN (Australian Business Number) to register for GST, we can help you with that too.

Should I register for GST if my turnover is below the threshold? Sometimes new businesses register for GST early so they can claim GST credits on purchases of capital items and stock. We discuss this more in Section 2, but we always recommend getting advice from a qualified Tax Accountant when making these decisions.

Online BAS Lodgements

Expert BAS lodgement services by the expert Chartered Accountants at POP Business!

Charging GST on your sales

If you’re all setup with an ABN and registered for GST you’ll need to add GST to everything you sell (unless the item or service is classed as tax-free). GST is generally 10% of the sale price, but can vary if you sell food, beverages, health products and essential services.

Apart from collecting the GST from your customers, you’ll also need to issue proper ‘tax invoices’ within 28 days of the sale. A tax invoice must have:

- ‘Tax Invoice’ (or similar) clearly displayed.

- Your business name and ABN.

- Date of invoice.

- Description of the goods you sold.

- Total charged to the customer.

- Amount of GST included in the sale.

Setting your prices (so you make enough money), configuring your invoicing and point of sale (so you comply with the law) and getting the tax right (so you pay the correct amount to the ATO) can be tricky — especially if you sell food and beverages. We always recommend seeking advice from a registered Tax Accountant or Tax Agent to make sure you are collecting (and invoicing) the GST correctly.

Here’s a quick example to demonstrate the complexities of a small food business:

You’re a bakery and sell your products over the counter to customers. Pies, cakes, and pastries will all attract GST, but bread, flour and bread rolls won’t. Then there’s the drinks fridge: Coke, Pepsi, and flavoured milks will all need GST added, but bottled water and plain milk are GST-free.

2. Business Activity Statements

The Business Activity Statement (also known as BAS) is the way Australian businesses record the amount of GST they have collected and owe to the government. Most small businesses are required to lodge their BAS return (and pay the GST they owe) every quarter — but it is possible to opt for monthly or yearly lodgements. This will depend on the size and complexity of your business, and the ruling of the ATO.

The Australian Taxation Office has strict BAS lodgement dates so it’s worth-your-while to record these in your calendar (and set un-ignorable reminders):

| Lodgement Period | Reporting Period | Due Date |

| 1st quarter | July to September | 28 October |

| 2nd quarter | October to December | 28 January |

| 3rd quarter | January to March | 28 April |

| 4th quarter | April to June | 28 July |

Did you know? If you use a Tax agent or Tax Accountant you get a full month’s extra time to lodge your BAS and pay the GST bill. Get in touch to learn how a POP Business Tax Agent will help you maximise cashflow.

Calculating your GST payment or refund

Up until now we’ve only really talked about the GST that your business charges to your customers. But the ATO realises that every business in Australia will also be paying GST to its own suppliers. These GST payments can be claimed back as credits when you lodge your BAS return.

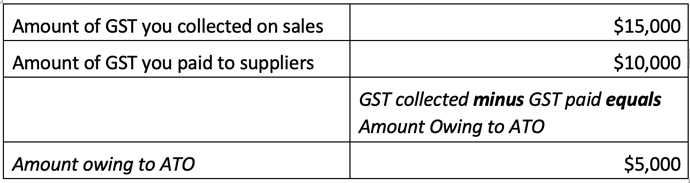

So in very simple terms, calculating your BAS return looks a bit like this:

If sales are low, or you’re just starting out and purchased a lot of capital items through the quarter, you might actually receive a GST refund. Here’s how that might look:

To correctly prepare your BAS you’ll need a way of tracking the amount of GST you’ve charged to customers, and the GST you’ve paid to suppliers. In Section 3 we’ll unpack this in more detail and also explain the cash and accrual accounting methods required by the ATO.

Preparing a simple BAS

For most small businesses, your Business Activity Statement is a simple form that summarises the GST and other taxes you’ve withheld during the quarter. Here’s the minimum amount of information you must report on your BAS form:

- Amount of GST you owe the tax office (or are claiming as a credit).

- Amount of PAYG tax you have withheld from employee wages (including your own salary).

- Any variations to your GST payment (if you made a mistake on an earlier BAS, or have to adjust your figures because of bad debts, rebates, and cancelled sales).

- Variations to your PAYG tax payment (due to error on a previous return).

- Total amount being remitted to the ATO.

Larger, or more complex businesses might also be reporting on Fringe Benefits Tax (FBT), Luxury Car Tax (LCT), Wine Equalisation Tax (WET) and Fuel Tax credits. Always talk to your Tax Agent or Tax Accountant before completing the variations section on your Business Activity Statement, or if you’re unsure about your other tax responsibilities.

How do I do a BAS statement?

Lodging your BAS,

How do I do a BAS statement? How do I lodge BAS? If you aren’t using a Tax Agent, there are a number of ways to fill out your form and lodge your BAS. They include:

- ATO Business Portal — for larger businesses to fill out their BAS lodgement form online.

- MyGov website — for sole traders to fill out the BAS lodgement form online.

- SBR Enabled software — a way to lodge directly from your accounting and payroll software.

- Paper lodgement — fill out a paper BAS form and mail the original to the ATO.

- Phone lodgement — if you have a ‘nil’ return you can notify the ATO by phone.

Both the BAS form and the GST payment must be lodged before the due date. You can pay online with a credit card (fees apply), BPAY, over the phone, in person at Australia Post, by mail (cheque/money order), or electronic bank transfer. Even if you’re getting a refund, you must still lodge by the due date.

GST tip: If you aren’t using accounting and payroll software, we always recommend lodging your BAS online because it gives you instant access to all the BAS returns you’ve lodged in the past. You’ll also get more time to pay, and be able to share the information with your Tax Agent and Accountant.

3. Using an accounting system to track GST

Many small businesses try to save money by tracking their income (GST collected) and expenses (GST paid) with spreadsheets. But once you’re registered for GST this really isn’t good enough. You have a legal obligation to keep detailed records of all the GST you’ve collected, as well as the GST credits you’re claiming.

A decent accounting package like Xero, MYOB, or Quickbooks is a much better choice than spreadsheets and will allow you to:

- Raise tax invoices for your customers.

- Hook into your cash registers and point of sale (POS) data.

- Correctly process wages, salaries, PAYG tax and other deductions.

- Store receipts and invoices for the GST you’ve paid to suppliers.

- Reconcile receipts and payments with your bank accounts.

- Generate end-of-quarter GST reports that match the information required on you BAS form.

- Lodge your BAS direct from the software — without having to use the ATO portal or fill out the form.

The ATO has a very low tolerance for sloppy accounting and incorrect lodgements. A computerised accounting package is a worthy investment that will save you time, money, and headaches.

Want a 20% lifetime discount on your XERO software? Reach out to our expert accounting team here at POP Business — for Australia’s best prices on Xero accounting software and down-to-earth assistance.

Cash and accruals accounting

There are two ways that your small business can account for the GST your collect and pay. You can choose from either:

- Cash accounting — GST is reported and paid to the ATO when the cash was received. Eg, you send an invoice on the 27th June to your customer, they pay the invoice on the 2nd GST is due in the July-September quarter.

- Accruals accounting — GST is reported and paid to the ATO when the invoice was raised. Eg, you send an invoice on the 27th June to your customer, they pay the invoice on the 2nd GST is due in the April-June period quarter.

How do I lodge BAS? Choosing between cash and accruals accounting can impact your cashflow, so always check with your Tax Agent or Accountant before setting your accounting method.

Claiming credits for GST you’ve paid

A lot of small businesses get into trouble with the taxation office by trying to claim GST credits on everything they buy. GST credits can only be claimed for business-related purchases — they are not available for personal expenses.

Here’s a few examples to give you an idea, but it’s always best to talk with your Tax Accountant or Tax Agent about the things you can (and cannot) claim. This is especially true if you have regular expenses that are split between home and business use.

Expense | GST credit |

| Business phone or mobile service | YES |

| Computer software for your business | YES |

| Loan payments on your work vehicle | YES |

| Regular clothes you wear to work | NO |

| Lunches and snacks | NO |

| Loan payments on your son’s car | NO |

Did you know? To claim GST credits on items costing more than $82.50, you must have a tax invoice to support your claim. Tax invoices (and other accounting data) must be kept for at least 5 years. We always recommend using an accounting system to track (and store) these invoices, making your GST reporting a whole lost easier.

4. Microbusiness and Sole Traders

If your business has less than 4 employees (or your a sole trader) then your business counts for more than 76% of Australian small businesses. This section lists some key considerations for all microbusiness owners:

Should you register for GST?

If your business is very small you don’t have to charge GST or complete BAS reports, but as your business grows you’ll need to consider the best time to register. This is a strategic decision that can impact your cashflow, profitability, and legal compliance, so talk to a registered Tax Agent or Tax Accountant before making this decision.

Open a tax holding account

Make sure you always have enough money to pay your quarterly BAS by putting the GST you collect (and the PAYG tax you withhold) into a separate bank account. We suggest putting away 10% of your weekly sales + a weekly estimate of PAYG into the account.

Use cash accounting

Microbusinesses and sole traders are extremely vulnerable to cashflow issues. The ATO suggests (and we do too) using the cash accounting option to align your GST liabilities with your business cash flow.

Use business accounting software

Keep accurate records of the GST you’ve collected and paid. The taxation office doesn’t tolerate excuses and ’guesstimates’ — and you don’t want to be lumped with a fine or have to pay extra GST just because you couldn’t be bothered to keep receipts. Business accounting software will make this whole process much easier.

Take advantage of concessions

Many small businesses are eligible for tax concessions which can reduce the amount of tax you have to pay, or allow you to pay your tax by instalments. Small business concessions can arise at anytime (Jobkeeper and COVID19 concessions being a clear example) and your Tax Agent or Tax Accountant will keep you up-to-date on your eligibility.

Use a Tax Agent or Accountant

A Tax Agent or Accountant who has been registered with the ATO will make sure your BAS is lodged correctly, your tax is paid on-time, and you are receiving all your concessions and entitlements.

5. Reach out for help with your BAS

Our blog today has given you a simple introduction to GST and Business Activity Statements for small business — but maybe you still have questions, or feel concerned you aren’t reporting your tax obligations correctly?

Please reach out to the team here at POP Business. We are dedicated to the longterm success of your business and can assist you will all aspects of your GST collection, reporting, and BAS lodgements. Ask us about:

- Registering your small business for GST.

- Setting up your accounting software, POS, and invoicing system.

- Ensuring you’re charging the correct amount of GST to your customers.

- Lodging your Business Activity Statement correctly.

- Making sure you are claiming all your GST credits.

- Preventing expensive mistakes, fines and penalties.

- Maximising small business concession and entitlements.

Online BAS Lodgements

Expert BAS lodgement services by the expert Chartered Accountants at POP Business!