The 2022 federal budget comes at a time where Australia’s strong economic recovery is expected to continue with broad-based growth in consumption, investment and exports alongside a stronger labour market, rising wages, income tax cuts, and stronger household income growth.

Global and local economic conditions continue to be a challenge to the economy, with Russia’s invasion of Ukraine, the ongoing pandemic, and resulting inflation pressures present risks to families and businesses. Nonetheless, the resilience of the Australian economy throughout the pandemic demonstrates that the economy is well placed to adapt to these new developments.

A strong focus of the 2022 federal budget is on skills and training, with significant spending on new programs to upskill Australians. There has been large spending on the digitisation of businesses and record spending on cyber security. The objective of the Digital Economy Strategy is to make Australia a top 10 data and digital economy.

2022 Federal Budget - Key highlights

The key announcements of the 2022 budget were:

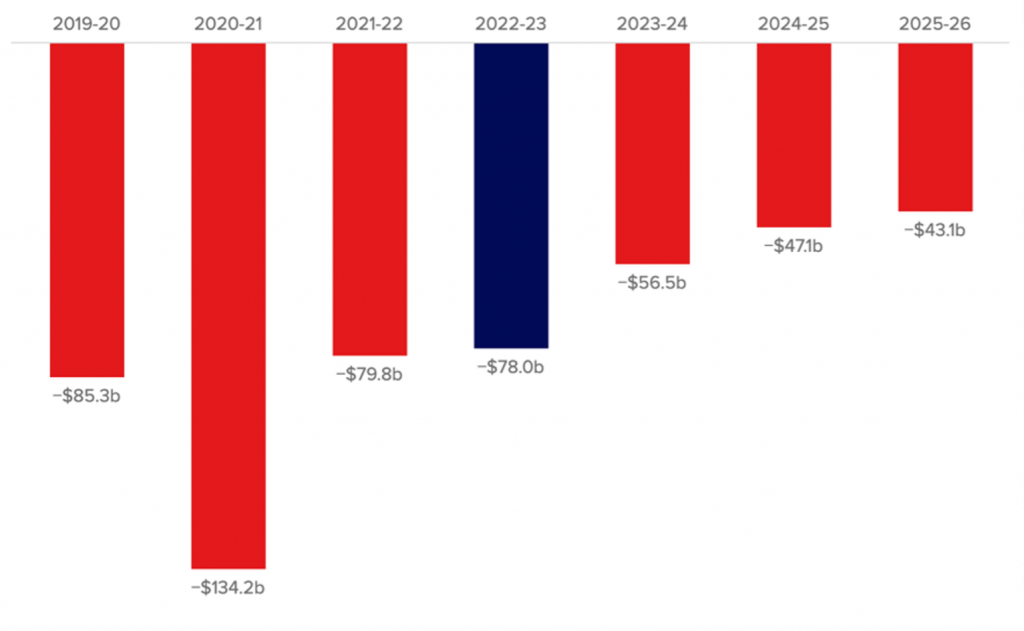

- A $78 billion underlying cash deficit forecast for 2022-23, $20.9 billion better than forecast in the December 2021 Mid-Year Economic Fiscal Outlook

- Cost of living package to address rising costs includes a temporary fuel excise cut, one off payments of $250 to eligible recipients and an increase of $420 to the Low-to-Middle-Income Tax Offset

- 120% tax deduction for small businesses to upskill employees and encourage digital adoption

- Expansion of the Patent box regime to the low emissions technology and agricultural sectors

- Responses to climate and natural disaster impacts, alongside continued focus on low emissions technology and energy security

- Extra funding announced for COVID-19 ($6 billion), mental health (further $547 million over 5 years), aged care (further $468.3 million over 5 years) and $39.6 billion to continue the NDIS program

- Significant funding allocated to build resilience into Australia’s infrastructure networks

- Significant investment in readiness of the workforce for the digital economy

- Parents in charge; more flexibility in Paid Parental Leave.

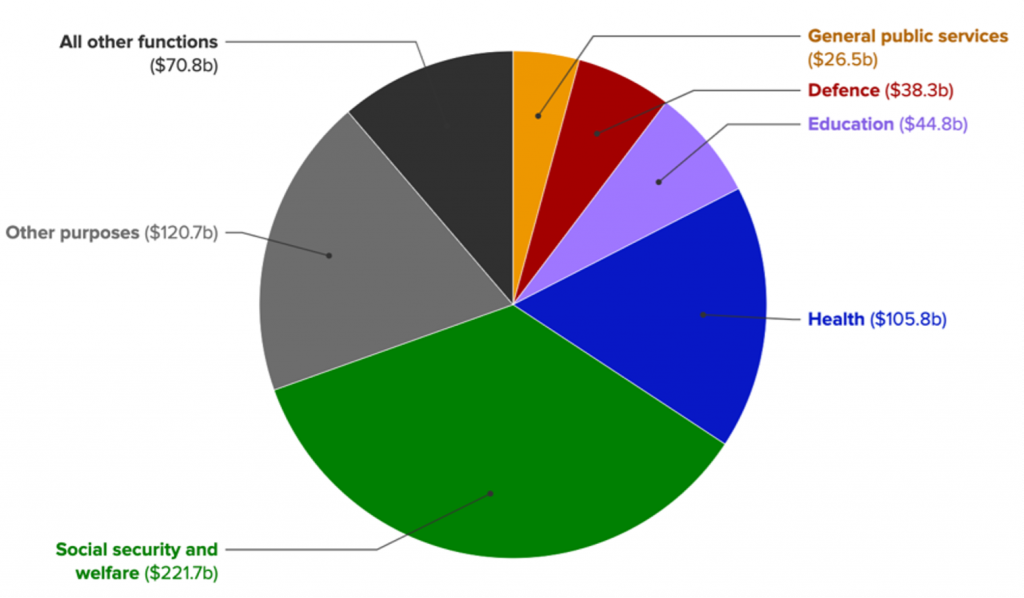

Government Spending

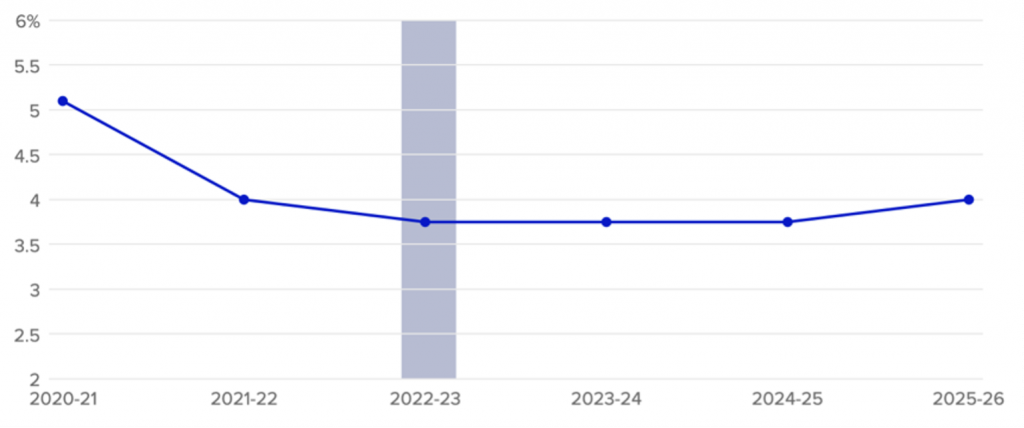

Unemployment Rates

Unemployment has come down from the covid-19 peak and is forecasted to remain low until the forecasted period of 2025/26. Low unemployment will ensure the economy remains strong and will continue to grow. This will mean a tight jobs market will continue which is already seeing shortages, noting there is strong forecasted immigration numbers which will hopefully provide some skilled labour to help with the shortages.

2022 Budget Defecit

The budget deficit will improve off the back of a stronger than expected recovery with commodity prices significantly improving the 2022 budget deficit.

Specific business measures which may impact you and your business.

In this section, we’ll dive into the new federal budget 2022 measures that may impact businesses. For more information on measures impacting individuals such as the cost-of-living measures, we recommend visiting budget.gov.au.

Employee Share Scheme (ESS) reform

The government has been working on ESS reform for the past year, with changes being passed in February 2022. Under the new changes, employees will not be taxed on their ESS when they leave a company.

There is no maximum number of options or shares that can be granted and the value cap has been increased from $5,000 to $30,000 per year.

Further, there will be less reporting and disclosure requirements moving forward which is a welcome move.

This is a welcome move and we would expect to see more businesses offering share schemes to their employees given the reduction in red tape and the enhanced changes.

Training – Additional 20% deduction

A skills and training boost will enable eligible businesses with a turnover of less than $50 million to deduct an additional 20% of expenditure incurred on external training courses provided to employees. The boost applies from budget night until 30 June 2024.

For expenses incurred from budget night until 30 June 2022, these will be deductible in the 2023 business tax return.

Digitisation of business – Additional 20% deduction

A technology investment boost will allow small businesses to deduct an additional 20% of the costs incurred that support their digital adoption, such as cloud-based services, portable devices, security and other digital-related expenses.

The annual cap will be $100,000 in total per annum and will run until 30 June 2023. For any expenses incurred from budget night until 30 June 2022, these will be claimed in the 2023 tax return.

Low-middle income tax offset increased

From 1 July this year, over 10 million individuals will receive a one-off $420 cost of living tax offset. Combined with the low and middle income tax offset (LMITO), eligible low and middle-income earners will receive up to $1,500 for a single income household, or up to $3,000 for a dual income household.

Quarterly Pay As You Go instalments reduction

Pay as you go tax instalments usually increase at a GDP rate of 10% per annum factoring in business growth and inflation. With the 2022 federal budget, this will now be reduced to 2%, reducing the quarterly instalments.

Gender neutral paid parental leave

The government will provide the same benefit of 20 weeks (previously 18 weeks for the mother and 2 weeks for the father was provided), however, they will be able to choose who receives this benefit. This is particularly useful if the mother is the primary breadwinner. The combined family income has also increased to $350k (from $153k/individual).

Fuel excise reduction

A fuel excise reduction of 50% (44c/litre down to 22c/litre) will be implemented to ease the fuel costs over the coming 6 months.

Apprenticeship subsidy extension

The boosting Apprenticeship Commencements wage subsidy will be extended for another 3 months until 30 June 2022. An employer who takes on an apprentice up until 30 June 2022 can access up to 50% of their salary or $7,000 per quarter per apprentice and reduces to 10% and 5% over the coming 2 years.

From 1 July 2022, a new streamlined apprenticeship incentive system will be introduced to provide further support to employers and apprentices in priority occupations.

Superannuation for first home savers

From 1 July 2022, the maximum amount of voluntary contributions that can be released under the FHSSS will be increased from $30,000 to $50,000 enabling first home owners to achieve their dreams of home ownership sooner.

Book a 2022 Federal Budget Consultation

If you have any questions about how the 2022 federal budget will impact your business, please contact us today on 1300 180 630. We also offer ongoing business advisory services to provide year-round support for you business and keep you up to date on any government grants or budget measures that will impact your business. Get in touch to learn more.

Business Advisory Services

Set your business on the path to success with our expert business advisory services. Forecast your cash flows, get strategic advice, budgeting support and more. Speak to one of our consultants today on 1300 180 630 or follow the links to find out how we can help you.