Bookkeeping is the process of recording financial transactions of a business within the accounting software. It is further defined as the process of recording, reconciling, tracking and monitoring the business transactions in a reliable and accurate manner.

The most common tasks of a bookkeeper include;

- Bank Reconciliations

- Accounts Payable

- Accounts Receivable

- Payroll

- Recording, filing and managing receipts

- Reimbursement management

What is a bank reconciliation?

A bank reconciliation involves allocating transactions from the bank statements into the financial statements. As a result, this will build the Profit and Loss statement. This is where you will track your business income and expenses which provides insights into how much profit your business is making.

What Does a bookkeeper need to know?

Bookkeepers will have a basic understanding of employee

entitlements including how to account for leave. In addition to this, a good bookkeeper will know GST requirements, important lodgement dates, document filing requirements and some general terms and conditions of trade.

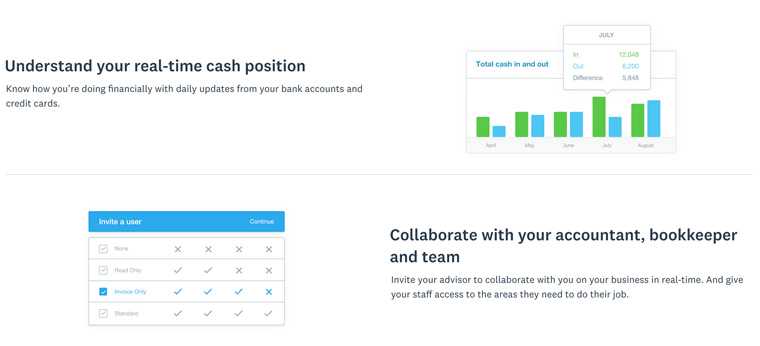

Further, they will know how to use accounting software to automate processes. Functions to automate may include bank reconciliations, payments, accounts payable, accounts receivable, and payroll. Being efficient on a range of different accounting software is vital.

A good bookkeeper will set-up the chart of accounts using appropriate accounting standards and have a good understanding of what data needs to be tracked.

As an example;

A client wanted to know where their sales were coming from in order to determine where they should allocate their marketing budget. With this in mind, the team at POP created a tracking code in Xero to enable weekly, monthly and annual reporting on the source of the sale.

How often does the bookkeeping occur?

The frequency of the bookkeeping depends on the organisation. Usually, the bigger the organisation the more frequent the transactions and the higher the volume. As a result, extra care is needed to understand the company’s position on a daily basis given the time it takes attend to the bookkeeping.

If you are just starting out, then based on the above, it is a good practice to do the bookkeeping on a monthly basis. This is to ensure you are on top of your financial numbers.

What’s the legal Requirements?

As a business owner, you are legally required to keep any receipts, bank statements and invoices for a period of 5 years. Further, if you have employees, the requirements stretch to 7 years.

When do I engage a Bookkeeper or Bookkeeping services?

Firstly, you should only contract a bookkeeper if you can afford one. Secondly, it is important as a business owner that you have a basic understanding of how the bookkeeping works.

If your time is better suited not maintaining the books, then by all means, hire a bookkeeper. If you are just starting though, then transaction volume may be lower, so you can most likely handle yourself (just for the start).

POP Business specialise in bookkeeping and can provide training or handle the bookkeeping for you. We can also advise when to hire a bookkeeper.

See our monthly accounting packages here for more information.