In June 2020, the ATO commenced the ATO cryptocurrency letter notification system. For many people, they believe that cryptocurrency trading is anonymous, however this isn’t entirely true. The ATO is leading the world in enforcing the regulation of cryptocurrency and as part of this process, requires exchanges operating in Australia to declare the details of Australian investors.

ATO Cryptocurrency FAQs

Can the ATO track cryptocurrency?

Yes. The ATO track cryptocurrency activities tied to individuals. Exchanges operating in Australia, such as Binance, & Coinspot are required to report the details of Australian users to the ATO.

Do you have to pay taxes on crypto?

Yes. In most situations, the ATO tax cryptocurrency using the capital gains systems. For businesses, crypto taxes are reported differently.

Even events such as crypto to crypto trades are considered taxable events. According to Crypto Tax Calculator, approximately 60% of people don’t know that they’re liable to pay tax on these transactions.

Check out our full blog to learn more about each of these different crypto tax situations.

Crypto Tax Returns

Get in touch to start lodging your Crypto Tax Return with

POP Business or call 1300 180 630 to speak to one of our consultants.

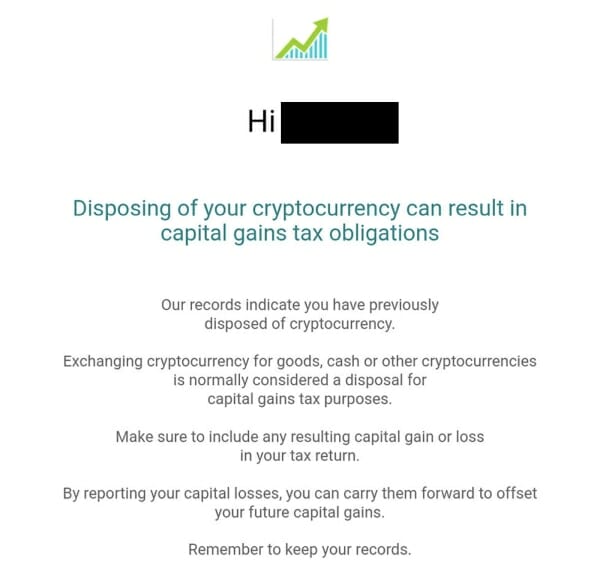

What do I need to know about the ATO cryptocurrency letter?

The ATO cryptocurrency letter is designed to notify individuals about their potential crypto tax obligations for the current financial year.

Through their regulation of crypto exchanges, the ATO has become aware of over 600,000 Australians that are engaged in cryptocurrency to some degree. In 2021, they will be issuing another 100,000 notification letters. These ATO cryptocurrency letters are designed to prompt individuals to educate themselves about tax obligations from the disposal of cryptocurrency.

Here’s an example of what the ATO cryptocurrency letter sent in 2020 looked like.

I received an ATO cryptocurrency letter about an audit – what does this mean?

The ATO also sends out ATO cryptocurrency letters for the audit or review of tax returns when they suspect that you have inaccurately reported your capital gains or failed to report them. If you are one of the individuals who receives one of these letters, you will have to respond or reconcile your activities within 28 days.

It is best practice to reconcile your returns during this 28-day window. If you wait until the ATO sends you a bulk assessment of your outstanding capital gains, they may not take into account your expenses or cost bases as an investor. They may only factor what they consider to be your assessable income. You’ll be better off reconciling it and declaring the correct amount, so you don’t get charged more than what you actually owe.

How do I amend my tax returns?

If you have outstanding crypto taxes to report, you can amend your tax returns by completing a form, online through myGov or by getting in touch with an accountant such as POP. Visit the ATO for more informaiton.

I received an ATO Cryptocurrency letter, what are might rights and obligations?

Rights:

- Treating you as being honest unless you act otherwise

- Accepting you can be represented by a person of your choice and get advice (accountant/tax agent)

- Giving you access to the information the ATO holds about you (under freedom of information act; useful if you’re filing an objection or review)

- Explaining the decisions made

- Respecting your right to a review

- Respecting your right to make a complaint

Obligations:

- Be truthful

- Keep the required records

- Take reasonable care

- Lodge by the due date

- Pay by the due date

- Be cooperative

How can I make sure I’m reporting my cryptocurrency tax obligations correctly?

Calculating your capital gains or losses on your tax return can be quite complicated.

At POP, we believe the most efficient way to calculate your capital gains and losses is to use a trusted calculation and reporting platform such as CryptoTaxCalculator (CTC). After you’ve generated a tax report from a platform such as CTC, you can use it to complete the relevant sections on your tax return.

CTC is based in Australia and is our trusted provider of accurate crypto tax reporting. They work with the ATO to ensure their systems are compliant with all the latest crypto regulations, so your tax report is as accurate as possible.

For extra validation, or if you have complicated transactions such as via decentralised exchanges, it is best to get an accountant such as POP to verify your crypto tax report is accurate and submit your tax return for you. If you need a Crypto Tax Return, get in touch with us and we’ll get your tax return sorted and make sure you meet all your obligations!

If you want to know more about capital gains and your ATO cryptocurrency reporting obligations, check out our blog here.

The information provided in this article is general in nature and is not tax, accounting or legal advice. It has been prepared without taking into account your objectives, financial situation or needs. Before acting on this information, you should consider the appropriateness of the information having regard to your own objectives, financial situation and needs and seek the professional advice of an accountant or qualified financial advisor.

POP PTY LTD (POP Business & POP Tax) disclaims all and any guarantees, undertakings and warranties, expressed or implied, and is not liable for any loss or damage whatsoever (including human or computer error, negligent or otherwise, or incidental or Consequential Loss or damage) arising out of, or in connection with, any use or reliance on the information or advice in this article. The user must accept sole responsibility associated with the use of the material on this site, irrespective of the purpose for which such use or results are applied. The information on this website is no substitute for specialist advice.